Samarthan Mahila Bachat ane Dhiran Sahakari Mandali Ltd.,Gujarat- 364001

Investment Schemes

How Micro Investment Schemes helpful?

Our micro-investment schemes, including minimal-amount fixed deposits, recurring deposits, and tailored plans like Yatha Shakti and Swarn Nidhi, are designed to empower women in rural areas. These schemes provide accessible and affordable investment opportunities, enabling women with modest incomes to start saving and build a secure financial future. We promote financial inclusion and encourage disciplined saving habits. Schemes like Swarn Nidhi specifically support educational expenses for girls, fostering long-term development and breaking the cycle of poverty.

Our Approach

Our approach focuses on empowering rural women through accessible and affordable micro investment schemes. We offer minimal amount fixed deposits, recurring deposits, and specialized schemes like Yatha Shakti and Swarn Nidhi to promote financial inclusion and disciplined saving. Our initiatives directly support educational expenses for girls, breaking the cycle of poverty and fostering long-term socioeconomic development. Through these initiatives, we enhance economic stability, financial independence, and contribute to the overall social and economic development of our members.

Our Investment Schemes

.png)

Swarna Nidhi (5-year Plan) for Girl Child (2 to 18 yrs) of Member

-

Minimum monthly investment: Rs 200/-

-

Interest rate: 6% per annum

-

Annual minimum deposit: Rs 2400/-

-

No maximum investment limit

-

Interest earned can be used towards the girl child's education or other expenses.

Yatha Shakti (3-year Plan)

-

Minimum monthly investment: Rs 100/-

-

Interest rate: 6% per annum

-

Annual minimum deposit: Rs 1200/-

-

No maximum investment limit

Samruddhi Suraksha (7-year plan) Fixed Deposit Scheme

-

Maturity period: 1 to 7 years

-

Interest rate: 6.5% to 10.6% per annum

-

Annual minimum deposit: INR 3,000/-

-

No maximum investment limit

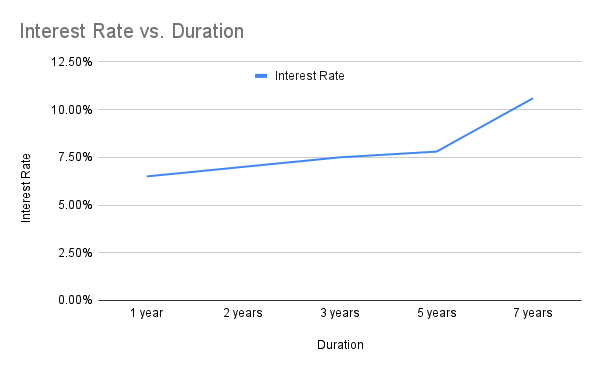

For a duration of 1 year, the interest rate is 6.50%. For 2 years, it is 7%, and for 3 years, the interest rate increases to 7.50%. A 5-year duration offers a rate of 7.80%, while a 7-year term provides the highest interest rate of 10.60%.

Samarthn Dhan Yojana (3-year plan) Recurring Deposit scheme

Vaibhav Nidhi is a recurring deposit scheme provided by the organization wherein the members can deposit a minimum amount of INR 1500 every month for a minimum period of 3 years. The interest will be given at the rate of 6% per annum. The investment can be extended further if the members wish to. There is no maximum limit on the amount of investment.

Note: The investment schemes are optional (voluntary) as per the request of the members